what is a deferred tax provision

This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19. A key point to be.

Define Deferred Tax Liability Or Asset Accounting Clarified

Furthermore a tax-exempt employer may claim the Work Opportunity Tax Credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans without regard to whether the employer has deferred deposit and payment of the employers share of Social Security tax.

. Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment. Deferred tax assets can arise due to net loss. It then creates a separate liability called a deferred tax liability for 2000.

More specifically we focus on how government support in the form of tax incentives and tax relief might change previous assessments that were made applying IAS 12 Income Taxes IAS 12. Deferred tax liabilities can arise as a result of corporate taxation treatment of capital expenditure being more rapid than the accounting depreciation treatment. The definition of a liability.

This is money your company knows it must pay at some point in the future. Since the Work Opportunity Tax Credit is processed on.

Deferred Tax Liabilities Meaning Example How To Calculate

How Is A Deferred Tax Liability Or Asset Created Quora

Deferred Tax Double Entry Bookkeeping

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

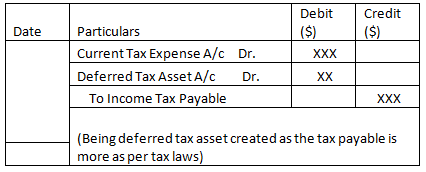

Deferred Tax Asset Journal Entry How To Recognize

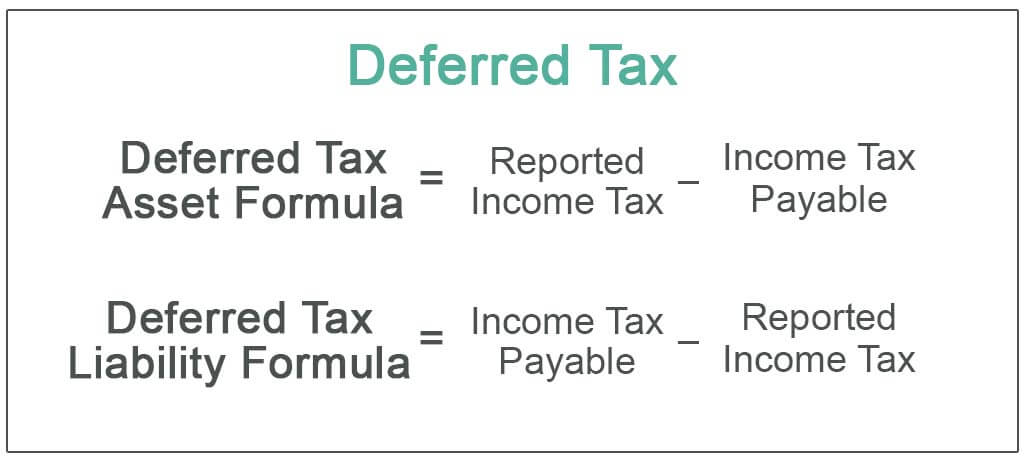

Deferred Tax Asset Deferred Tax Assets Vs Deferred Tax Liability

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Meaning Calculate Deferred Tax Expense

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Liabilities Meaning Example Causes And More

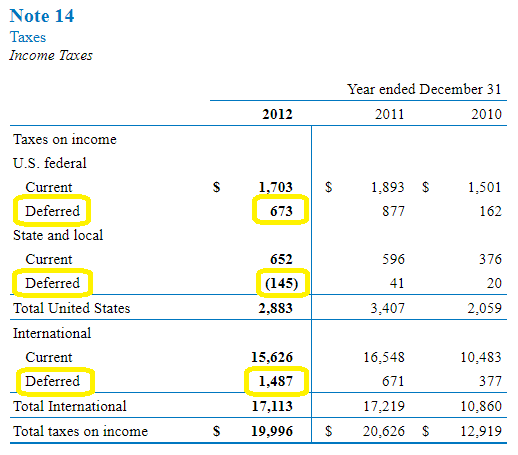

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

Computation Of Deferred Tax Liabilities

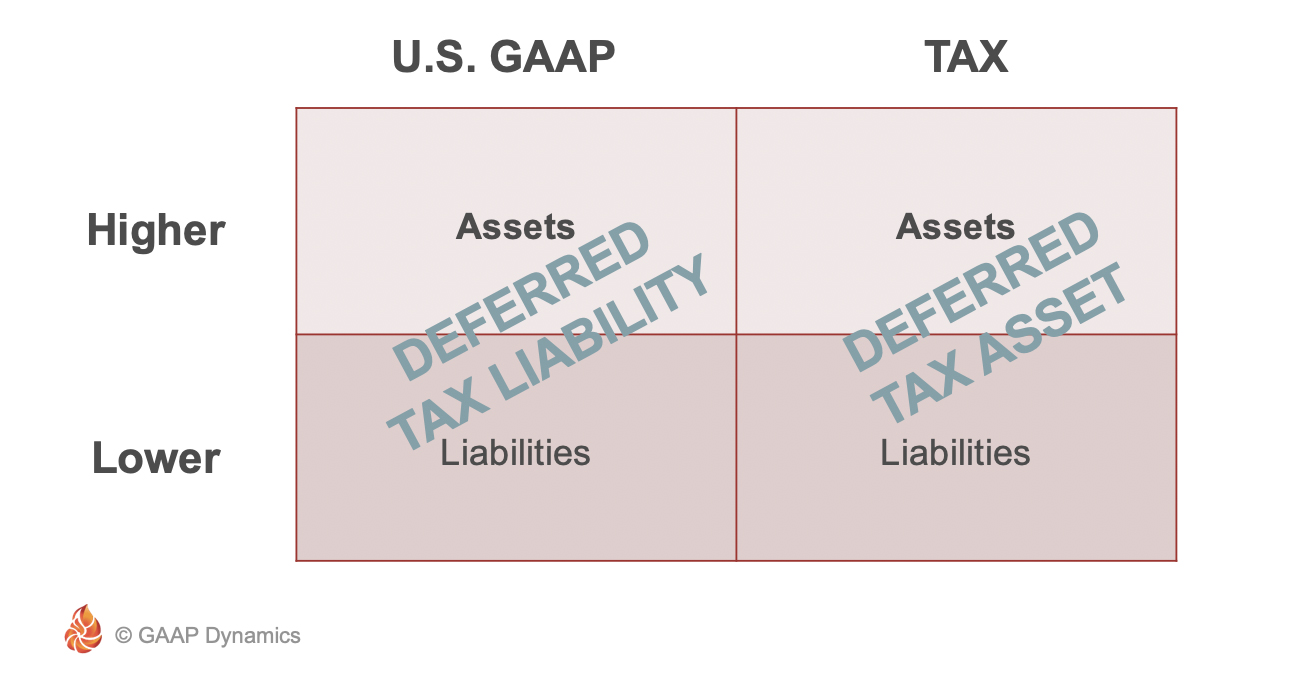

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics